The sources of funds for the purchase transaction are documented (such as bank statements, personal loan documents, or a HELOC on another property). The preliminary title search or report must confirm that there are no existing liens on the subject property. A recorded trustee's deed (or similar alternative) confirming the amount paid by the grantee to trustee may be substituted for a settlement statement if a settlement statement was not provided to the purchaser at time of sale. The original purchase transaction is documented by a settlement statement, which confirms that no mortgage financing was used to obtain the subject property. an LLC or partnership in which the borrower(s) have an individual or joint ownership of 100%.an eligible land trust when the borrower is the beneficiary of the land trust or.

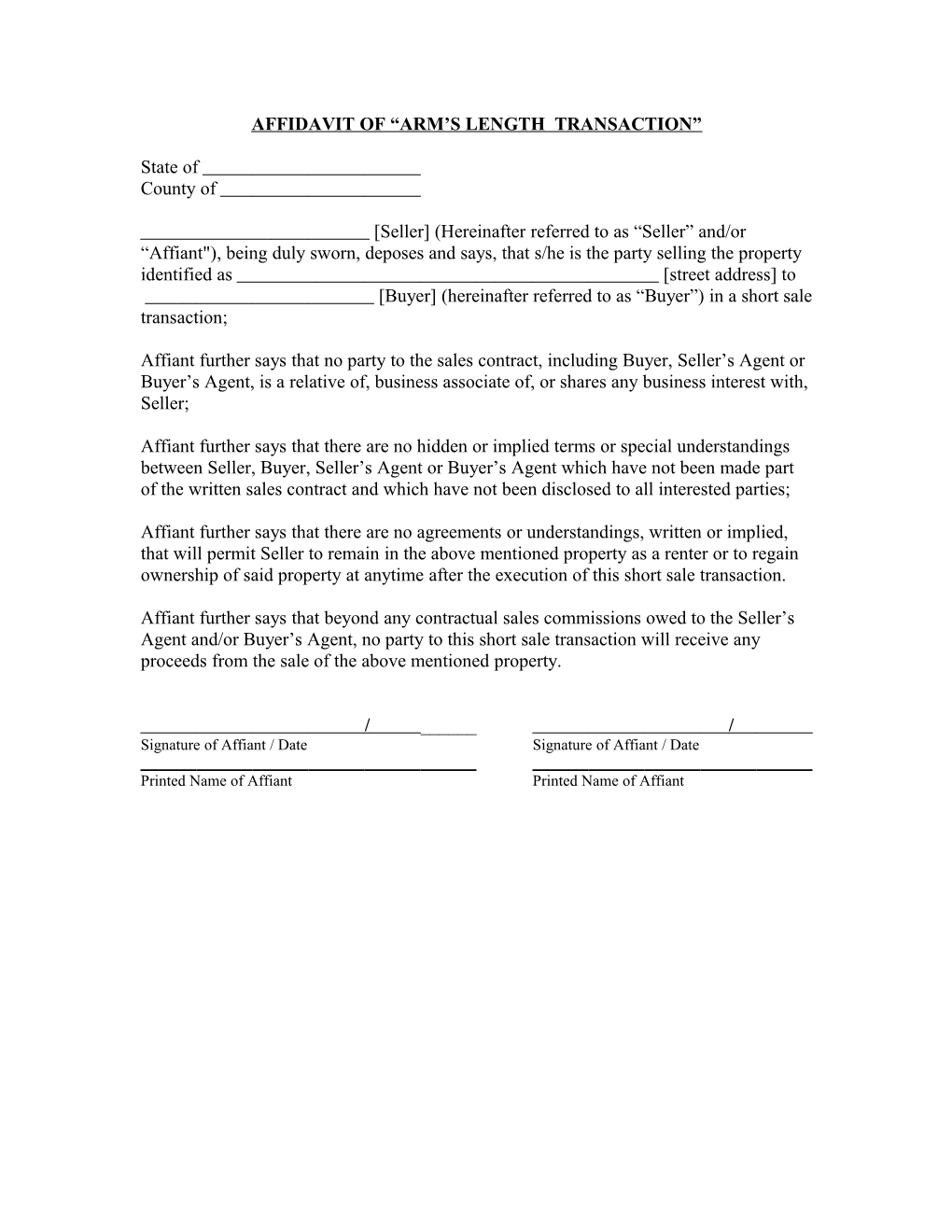

an eligible inter vivos revocable trust, when the borrower is both the individual establishing the trust and the beneficiary of the trust.The borrower(s) may have initially purchased the property as one of the following: The original purchase transaction was an arms-length transaction.įor this refinance transaction, the borrower(s) must meet Fannie Mae’s borrower eligibility requirements as described in B2-2-01, General Borrower Eligibility Requirements.

Requirements for a Delayed Financing Exception Borrowers who purchased the subject property within the past six months (measured from the date on which the property was purchased to the disbursement date of the new mortgage loan) are eligible for a cash-out refinance if all of the following requirements are met.

0 kommentar(er)

0 kommentar(er)